Semi Monthly: Everything You Need to Know About This Common Pay Frequency

Getting paid is great, right? But sometimes the “when” is just as important as the “how much.” Ever heard the term semi monthly and wondered what it really means? Whether you’re an employee or employer, understanding different pay frequencies—especially semi monthly pay—can make a big difference in how you manage finances or run payroll.

Let’s break it down so it’s super clear. This article will walk you through everything you need to know about semi monthly schedules, how they compare to bi weekly, and what the pros and cons are.

What Does Semi Monthly Mean?📘

Semi Monthly Meaning Explained 🔍

Semi monthly means “twice a month.” It’s often confused with bi weekly, but they’re not the same (more on that later). If you get paid semi monthly, it means you receive 24 paychecks per year—usually on the 15th and last day of each month.

What is Semi Monthly ❓

It’s a schedule used for salary payments or bills, where something happens two times a month. So, for instance, a semi monthly mortgage payment plan means you’re paying your lender twice every month. MORE…

Semi Monthly vs. Monthly vs. Weekly ⚖️

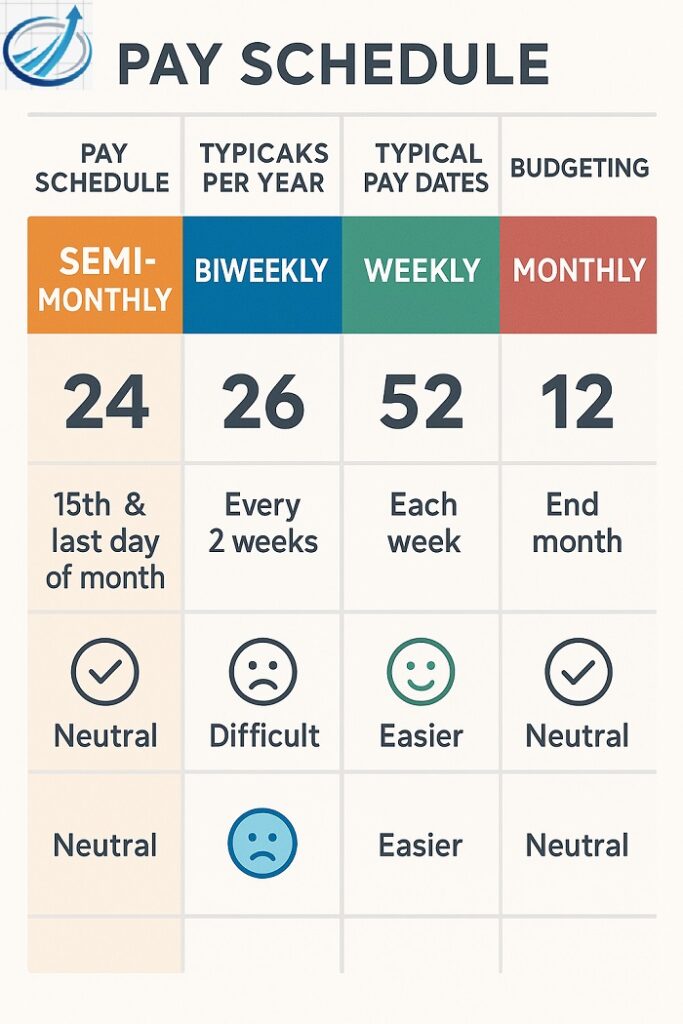

- Monthly: Once a month, 12 times a year

- Semi Monthly: Twice a month, 24 times a year

- Weekly: Every week, 52 times a year

Each has its own budgeting pros and cons. Semi monthly strikes a balance between the two extremes.

What is Semi Monthly Pay? 💵

How Semi Monthly Pay Works 🔧

Under a semi monthly pay schedule, you’re typically paid on the 15th and the 30th/31st of each month. If those days fall on weekends or holidays, you’ll usually get paid on the previous business day.

Examples of Semi Monthly Pay Dates 📆

Let’s say it’s March:

- March 15th (Wednesday)

- March 31st (Friday)

In this case, you’d get your paycheck on both those days.

Common Jobs Using Semi Monthly Pay 👔

Jobs that use semi monthly pay often include:

- Office jobs

- Salaried positions

- Government employees

- Educational institutions

Semi Monthly Pay Schedule 🗓️

Typical Semi Monthly Calendar 📊

Here’s how it usually looks:

| Month | Pay Date 1 | Pay Date 2 |

|---|---|---|

| Jan | Jan 15 | Jan 31 |

| Feb | Feb 15 | Feb 28 |

| Mar | Mar 15 | Mar 31 |

| … | … | … |

Setting Up a Semi Monthly Pay Schedule 🛠️

For employers, it means coordinating payroll to ensure payments are processed on fixed dates every month. This might involve automated payroll systems or coordination with accounting departments.

Pros and Cons for Employers 👍👎

Pros:

- Predictable payroll processing

- Aligns with monthly financial reports

Cons:

- More complex than bi weekly due to uneven workdays

- Needs manual adjustments for weekends/holidays

Semi Monthly Pay Calculator 🧮

How to Calculate Semi Monthly Pay 📝

Here’s the basic formula:

Annual Salary ÷ 24 = Semi Monthly Pay

Example Calculation 🧾

Let’s say your salary is $60,000 annually.

$60,000 ÷ 24 = $2,500 per paycheck

Tools to Help You 🧰

You can use online tools like:

- ADP Payroll Calculator

- PaycheckCity

- SmartAsset’s paycheck tool

These let you plug in your salary and deduct taxes to see your actual take-home.

Semi Monthly vs. Bi Weekly 🔄

Understanding Bi Weekly 📖

Bi weekly means you get paid every two weeks, typically resulting in 26 paychecks per year. That’s two more paychecks than semi monthly.

Bi Weekly vs. Semi Monthly: The Key Differences ⚔️

| Feature | Semi Monthly | Bi Weekly |

|---|---|---|

| Paychecks/year | 24 | 26 |

| Pay frequency | Twice a month | Every 2 weeks |

| Pay days | Fixed dates | Varies |

| Easier budgeting? | Not always | Often yes |

Which is Better for Budgeting? 📈

Many people find bi weekly easier to manage since paydays are more consistent. However, semi monthly can be simpler for budgeting monthly expenses like rent, utilities, etc.

Biweekly vs. Semi Monthly: Payroll Considerations 🧑💼

Employer Perspective 🏢

Semi monthly aligns better with monthly accounting. But bi weekly provides consistent pay periods, making it easier to calculate overtime.

Employee Perspective 🙋

Bi weekly pay means more frequent (though smaller) checks and two “bonus” months per year. Semi monthly is more predictable when it comes to calendar dates.

Which One Do Most Companies Use? 📊

It varies by industry. Large corporations and government jobs often use semi monthly. Smaller businesses and those with hourly workers may prefer bi weekly.

Conclusion ✅

So, what does semi monthly mean in plain terms? It means you’re getting paid twice a month—usually on the same two dates. It’s predictable, straightforward, and often used in salaried positions. While it’s not the same as bi weekly, both methods have their perks.

Understanding how you’re paid is crucial for budgeting, tax planning, and managing expenses. Whether you’re an employee trying to budget better or an employer deciding on a payroll system, knowing the ins and outs of semi monthly pay can make all the difference.

FAQs ❓

1. 🔁Is Semi Monthly the Same as Bi Weekly?

Nope! Semi monthly is twice a month (24 paychecks/year), while bi weekly is every two weeks (26 paychecks/year).

2. 📆How Many Paychecks Do You Get in a Semi Monthly Schedule?

You’ll receive 24 paychecks a year—two per month.

3. 🔄Can You Switch Between Pay Frequencies?

Yes, but it’s up to your employer and might involve updates to payroll systems and employee agreements.

4. ⚖️Is Semi Monthly Legal in All States?

In most cases, yes. But employers should always check local labor laws.

5. 🎉What Happens if Payday Falls on a Holiday?

Typically, your employer will issue payment on the last business day before the holiday.