When it comes to budgeting or breaking down your earnings, using a semi monthly pay calculator can save you both time and headaches. Whether you’re an employee trying to figure out your take-home pay or an employer streamlining payroll, this tool simplifies the numbers — and your life.

📆 What Is Semi-Monthly Pay?

Before diving into calculations, let’s clarify what semi-monthly means. A semi-monthly pay schedule gives you two paychecks per month, typically on the 1st and 15th or the 15th and last day of the month. That equals 24 pay periods a year.

🔄 Don’t confuse it with bi-weekly pay!

Bi-weekly means getting paid every two weeks, resulting in 26 paychecks per year. This difference might seem small, but it can affect your monthly cash flow.

🧾 Why Use a Semi Monthly Pay Calculator?

A semi monthly pay calculator is more than just a paycheck estimator — it’s a smart tool for managing your finances. Here’s why you should consider using one:

✅ Understand your true earnings

✅ Plan for bills and expenses more accurately

✅ Avoid surprises due to deductions

✅ Make informed decisions about savings and investments

It’s helpful for both employees and employers who want a clear view of gross and net income.

🔧 How to Use a Semi Monthly Pay Calculator

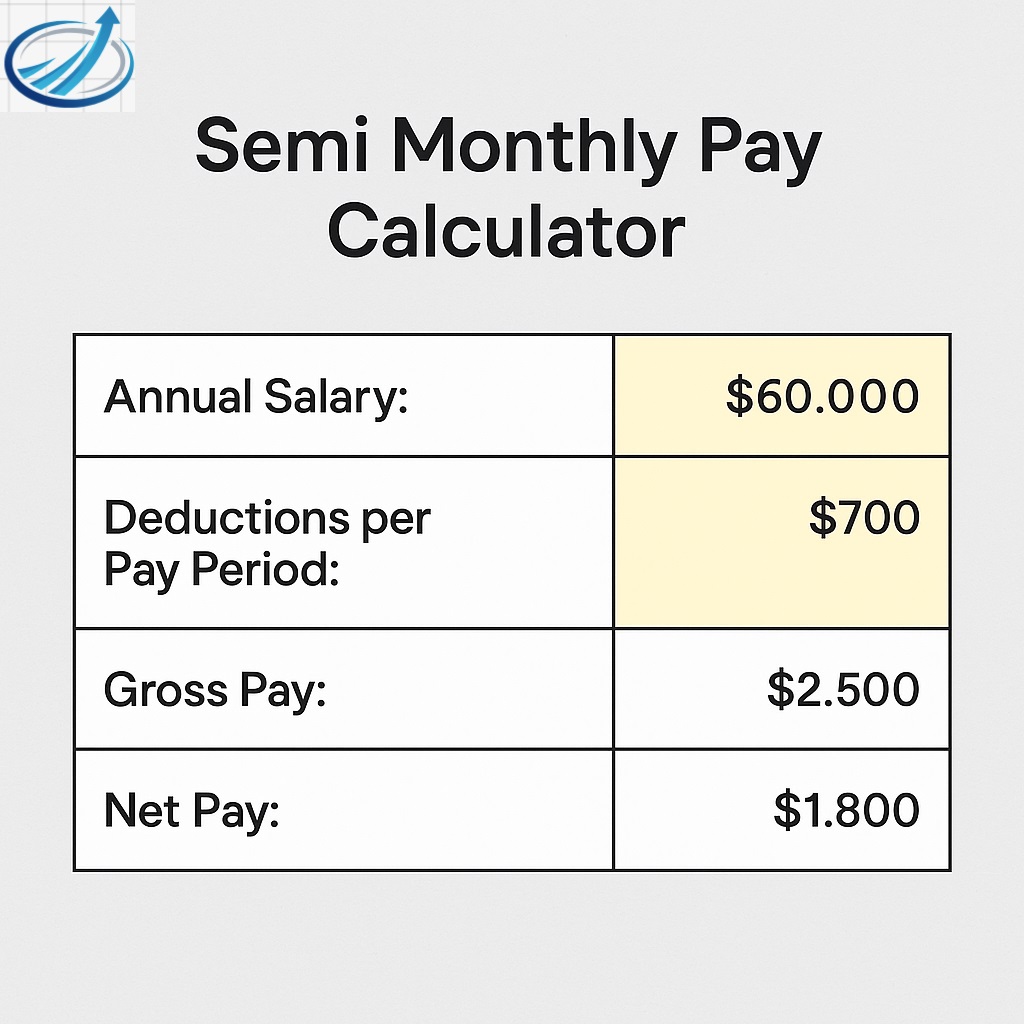

Using one is easier than you think. Most semi monthly pay calculators follow this basic format:

- 💼 Enter your annual salary

- 🧮 Input deductions (taxes, insurance, retirement)

- 🧾 Review your semi-monthly gross and net pay

For example, if your annual salary is $72,000, divide it by 24: $72,000 ÷ 24 = $3,000 per paycheck (gross)

If deductions total $600: $3,000 – $600 = $2,400 take-home pay

Some calculators even offer side-by-side views of semi-monthly vs. bi-weekly payments for easy comparison.

📊 Benefits of a Semi-Monthly Pay Schedule

💡 Consistent Budgeting – Aligns perfectly with monthly bills like rent and utilities

💼 Fewer Payroll Runs – More efficient for companies

💵 Stable Paychecks – Easier to predict than hourly or weekly pay structures

Pair that with a semi monthly pay calculator, and you’re looking at smooth financial planning all year long.

❓ FAQs About Semi Monthly Pay Calculator

🔹 Q1: What’s the difference between semi-monthly and bi-weekly pay?

A: Semi-monthly means you’re paid twice per month (24 times a year), while bi-weekly means you’re paid every two weeks (26 times a year). The amounts per paycheck differ slightly.

🔹 Q2: Is semi-monthly better than bi-weekly?

A: It depends. Semi-monthly aligns with monthly bills, which helps with budgeting. However, bi-weekly gives you two extra paychecks each year, which can be helpful for saving or paying down debt.

🔹 Q3: Can hourly workers use a semi-monthly pay calculator?

A: Absolutely! Just multiply your hourly rate by the number of hours worked per pay period, then use the calculator to account for deductions.

🔹 Q4: Are taxes different for semi-monthly pay?

A: Tax rates stay the same, but the amount deducted per paycheck may vary slightly depending on your pay frequency and filing status.

🔹 Q5: Can I create my own semi-monthly pay calculator?

A: Yes! Many Excel or Google Sheets templates allow you to build a custom calculator by inputting formulas for gross pay, deductions, and taxes.

🎯 Final Thoughts

A semi monthly pay calculator takes the guesswork out of your income and empowers you to plan with precision. Whether you’re managing your personal finances or running payroll for a business, this tool ensures clarity and control over your cash flow.

So why wait? 🖩 Start using a semi monthly pay calculator today and take the first step toward smarter money management!