Understanding the Basics 🧠

Have you ever been told you’re on a “semi-monthly” pay schedule and thought, What does that actually mean? You’re not alone. Many people confuse it with bi-weekly pay, and it’s easy to see why. So let’s break it down clearly and simply.

Semi-monthly pay means you’re paid twice a month, usually on set calendar dates like the 15th and the last day. That’s it. No rotating weeks or paycheck surprises—just a consistent pattern that helps with budgeting and planning.

Why Semi Monthly Pay Matters 💼

Knowing your pay schedule isn’t just about marking payday on your calendar. It affects:

- How you budget 🧾

- When your bills are paid 🏠

- How often you save or invest 💰

Getting paid on the same dates every month can give your finances a rhythm. If your rent is due on the 1st and your car payment on the 20th, knowing exactly when your money is coming helps you stay on track.

Semi Monthly vs. Biweekly: What’s the Real Difference? ⚔️

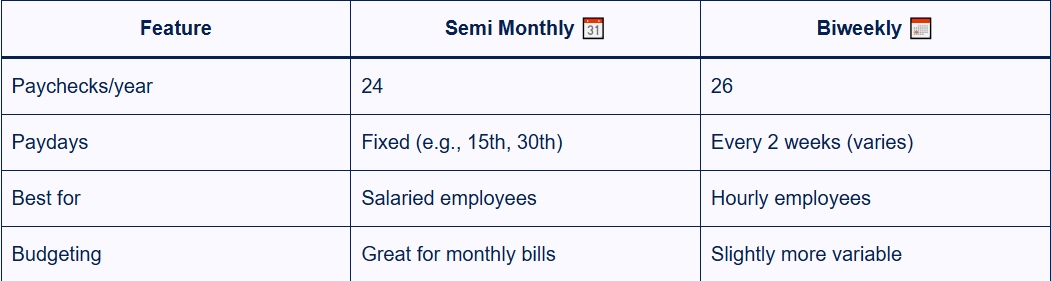

Let’s get into the comparison that confuses people the most.

| Feature | Semi Monthly 📆 | Biweekly 📅 |

|---|---|---|

| Paychecks/year | 24 | 26 |

| Paydays | Fixed (e.g., 15th, 30th) | Every 2 weeks (varies) |

| Best for | Salaried employees | Hourly employees |

| Budgeting | Great for monthly bills | Slightly more variable |

The key thing to remember is: semi-monthly sticks to the calendar, while biweekly follows the week pattern.

Who Typically Uses Semi Monthly Pay? 🏢

Semi-monthly pay schedules are more common in professional, salaried environments. You’re likely to find them in:

- Corporate jobs 💻

- Government roles 🏛️

- Finance or HR departments 📊

- Education and healthcare 👩⚕️

Hourly workers tend to be paid weekly or biweekly, where overtime is easier to calculate by the week.

A Real-Life Example of Semi Monthly Pay 💵

Let’s say your salary is $48,000/year. Here’s how that looks with a semi-monthly schedule:

👉 $48,000 ÷ 24 = $2,000 per paycheck

So, you’d earn $2,000 twice a month, usually on the 15th and last day. If either falls on a weekend or holiday, many companies pay the business day before.

🔔 Pro tip: Always double-check your company’s policy on this so you’re not caught off guard!

Pros and Cons of Semi Monthly Schedules 📊

Let’s weigh it out:

✅ Pros

- Predictable pay dates

- Great for aligning with monthly bills

- Simpler for salaried roles

- Less payroll processing than weekly systems

❌ Cons

- Trickier for hourly or shift workers

- Pay periods can be uneven (some months longer)

- Can be confusing for new hires

Tools to Help You Stay on Top of Your Pay 🧰

Here are a few handy resources to manage your money better on a semi-monthly schedule:

- Budgeting apps like Mint or YNAB 📱

- Calendar alerts for paydays 📅

- Savings automation that splits money into savings/investments 💸

- Semi-monthly paycheck calculators you can find online to estimate your take-home pay quickly

FAQs About Semi Monthly Meaning ❓

1. Is semi-monthly the same as biweekly?

Not quite! Semi-monthly is twice a month (24 paychecks), while biweekly is every 2 weeks (26 paychecks). 🧮

2. Do I get paid less on a semi-monthly schedule?

Nope—your annual salary stays the same. The paychecks are just split into 24 parts instead of 26.

3. What happens if payday is a weekend or holiday?

You’ll typically get paid on the nearest business day before. For example, if the 15th falls on a Sunday, your paycheck may arrive on Friday. 🎉

4. Can a company switch from biweekly to semi-monthly?

Yes, but it requires adjusting payroll processes and notifying employees in advance. 🔄

Final Thoughts ✅

Understanding the semi monthly meaning is more than just knowing when your paycheck lands. It’s about building a better financial rhythm and planning ahead with confidence. Whether you’re a new employee or just revisiting your payment plan, knowing the structure helps you take control of your money—and your peace of mind.